Advisors offer personalized wealth management services!

Unlike other advisors, the wealth management consultants we connect you with offer personalized wealth management solutions. You can rely on them to devise strategies and provide guidance tailored to your unique goals.They take the time to understand your financial situation, explore your aspirations, and identify your values. When it comes to wealth solutions, one-size-fits-all approaches simply don’t work. That’s why they listen to your needs and create strategies that are fully aligned with your objectives and preferences.

Reliable Wealth Management Specialists at your service!

Our wealth management consultants work closely with you to provide tailored wealth management solutions that align with your financial goals. Whether you're planning for retirement, saving for your children's education, or building a generational legacy, our experts offer comprehensive wealth solutions to help you succeed. With expert insights and strategic guidance, you can confidently navigate tax planning, asset allocation, and investment management while ensuring your wealth strategy aligns with your aspirations and risk tolerance. Let us simplify the complexities of wealth management—call us today and start securing your financial future!

Get comprehensive wealth management solutions!

Our expert wealth management consultants offer comprehensive wealth solutions tailored to your financial needs. From investment management and financial planning to estate planning, we provide a full spectrum of wealth management solutions designed to help you achieve financial security and long-term success. With personalized guidance based on your time horizon, financial objectives, and risk tolerance, our specialists help you build a strong wealth management strategy that aligns with your goals. Their expertise covers:

- Stocks

- Bonds

- Mutual Funds

- Alternative Investments

If you're looking to create a clear path toward long-term financial success, we can connect you with experienced wealth management consultants who analyze your financial situation, identify areas for improvement, and develop a roadmap for financial independence. Beyond growing your wealth, careful management and strategic planning are essential for smooth wealth transfer. Our consultants work closely with you to minimize taxes, preserve wealth, and secure your financial legacy for future generations. Let’s build your financial future today!

Ready to talk with the right advisors?

From helping you draft a will and establishing trusts to navigating complex tax laws, the right advisors offer you the expertise and guidance you need. You can count on them to take care of all your wealth management needs. With their help, you can navigate even the most complicated challenges not only in wealth management but also in pension planning and more. Reach out to us right away if you are ready to take control of your financial future with proper wealth management.

Why Choose State Pension Advisors for Wealth Management Services?

Building and preserving wealth requires more than just smart investments—it demands a comprehensive, strategic approach tailored to your unique financial goals. At State Pension Advisors, we specialize in providing expert wealth management solutions to state and university employees, helping you grow, protect, and transfer your wealth with confidence. Here’s why we’re the trusted choice for public sector professionals:

Comprehensive Wealth Solutions

We take a 360-degree view of your financial life, integrating investment planning, retirement strategies, tax optimization, insurance and estate planning into a cohesive wealth management solution. Our goal is to ensure every aspect of your financial life works together seamlessly to achieve your long-term objectives.

Personalized Strategies for Your Goals

No two financial journeys are the same. Our team of wealth management consultants works closely with you to understand your unique goals, risk tolerance, and time horizon. Whether you’re focused on growing your assets, preserving wealth, 401k management or planning for future generations, we create a customized strategy tailored to your needs.

Expertise in Complex Financial Planning

Wealth management goes beyond simple investments. Our wealth management consultants have deep expertise in navigating complex financial scenarios, including tax-efficient strategies, legacy planning, and risk management. We help you make informed decisions that align with your financial aspirations.

Transparent and Independent Advice

As independent wealth management consultants, we prioritize your best interests above all else. Our recommendations are transparent, unbiased, and free from conflicts of interest, ensuring your wealth is managed with integrity and clarity.

Frequently Asked Questions (FAQs)

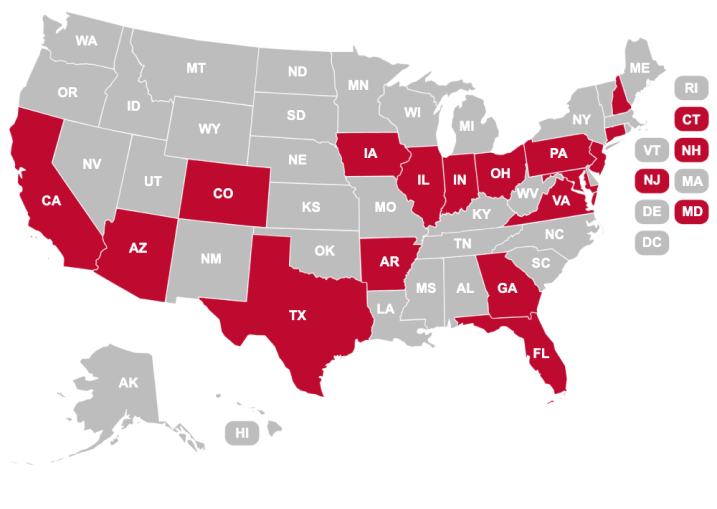

Areas We Serve

Arizona

Arizona

Colorado

Connecticut

Georgia

Illinois

Indiana

Iowa

New Hampshire

New Jersey