Your Reliable Partner for Retirement Planning!

We connect you with advisors who believe that everyone deserves to have a financially secure life even after their retirement. Therefore, they offer retirement financial advice to help you have a proper plan of action for a secure future. From savings to retirement investment planning and even taxes, they have you covered for every aspect of retirement planning in California. These well-vetted advisors know the cornerstones of a sound financial plan; they are always ready to pave the way toward achieving your financial goals.

Their retirement planning covers all the aspects of your financial life. They review your assets, income, and savings critically to come up with an integrated financial strategy. You can count on our investment retirement planner network can help you with:

- Unbiased and insightful financial advice for retirement planning

- Evaluating the amount of money you require post-retirement

- Planning to build, preserve, and grow your assets

- An investment strategy that works around your goals

- Creating a plan that covers retirement income, tax, and growth

- Minimizing taxes on funds withdrawn from tax-deferred accounts

Ready to talk with the right retirement planning specialists in California?

Professional advisors aim to deliver retirement plan services guided by the clients’ best interests. They take a comprehensive approach to retirement planning. The credible advisors not only create a retirement plan. In fact, they also help you periodically review it to make sure it aligns with your evolving goals. Their strategic plans offer proper guidance on maximizing returns, structuring efficiency, and minimizing risks.

Professional advisors are here to help you build the life you want to lead after retirement! With their retirement planning services in California, you are sorted for your streamlined future. Reach out to us today and let them help you move your financial life forward.

Frequently Asked Questions

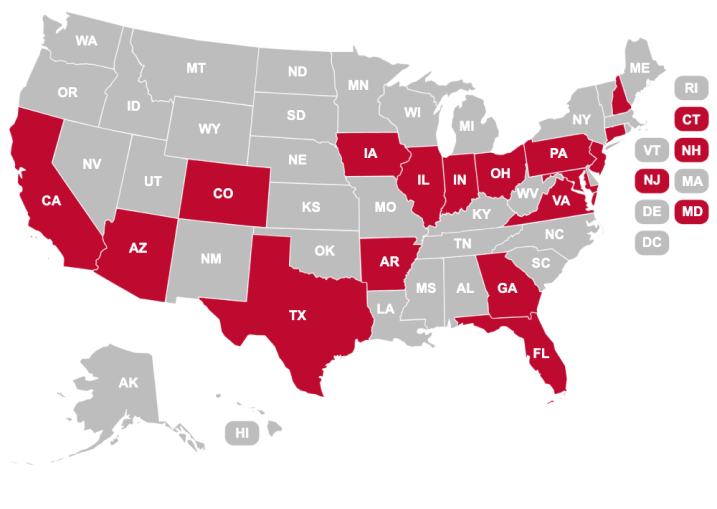

Areas We Serve

Arizona

Arizona

Colorado

Connecticut

Georgia

Illinois

Indiana

Iowa

New Hampshire

New Jersey