Understanding the Different Types of Wealth Management

When people think about managing their money, stocks and bonds often come to mind. But true financial success and security require more than just choosing investments. That’s where wealth management comes in. It’s a comprehensive approach designed to help you preserve, manage, and grow your wealth across many areas of life not just the markets.

If you’ve been searching for “types of wealth management,” you’re in the right place. In this blog, we’ll walk through the primary wealth management types, explain how they work, and show you why having the right advisor matters.

What Is Wealth Management?

Wealth management is a professional advisory service that supports individuals and families in protecting and expanding their wealth while aligning financial decisions with long-term goals. While it is often associated with high-net-worth individuals, many high earners use wealth management strategies to lay the foundation for future financial independence.

Instead of focusing only on short-term gains, financial advisors provide a holistic framework so you can balance today’s needs with tomorrow’s opportunities.

Primary Wealth Management Types

Wealth planning and management isn’t just one thing it’s a blend of strategies tailored to cover all aspects of your financial life. Here are the five primary types of wealth management you should know:

- Financial Planning

Financial planning creates the foundation for everything else in wealth management. A skilled advisor will help set realistic short- and long-term goals, build budgets, plan retirement contributions, and prepare for big life milestones. - Asset Allocation

Asset allocation is about strategy. Advisors help distribute your resources across different investments—such as equities, fixed income, and cash equivalents while balancing risk tolerance and market opportunities. - Asset Management

Once the allocation plan is designed, asset management ensures those investments are continuously monitored and adjusted as markets shift. The focus here is on performance, capital preservation, and long-term growth. - Estate Planning

Estate planning secures your legacy. Advisors guide you in structuring wills, trusts, and beneficiary designations to ensure your wealth transitions smoothly to the next generation or to causes you care about. - Tax Planning and Accounting

Taxes can significantly impact wealth. A proactive tax strategy maximizes available deductions, minimizes liabilities, and accounts for the complex tax consequences of investments, real estate, or business ownership.

Related tag - life insurance retirement plan

Why Understanding These Types Matters

Each of these wealth management types serves a unique purpose, but together they form a comprehensive system. Without professional guidance, managing all five areas can quickly become overwhelming. Having a trusted financial advisor prevents costly mistakes, reduces stress, and ensures your wealth is not just maintained—but grown strategically.

Choosing the Right Wealth Management Partner

How State Pension Advisors Can Help You Manage Wealth Effectively?

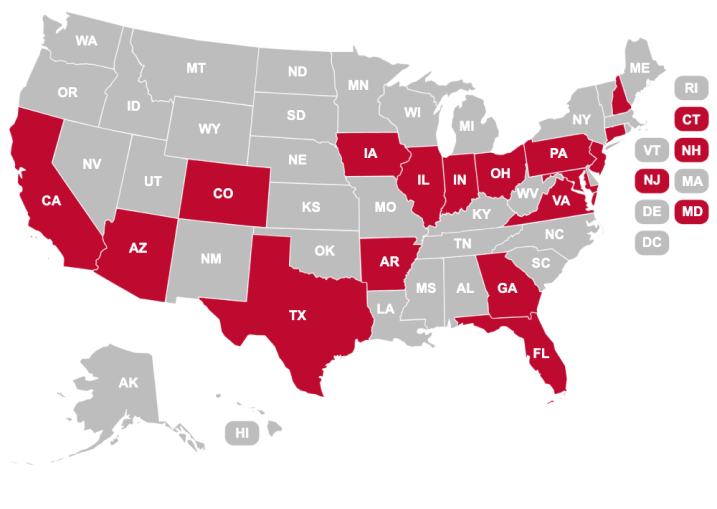

For many state government and university employees, managing wealth requires specialized knowledge especially when your financial picture includes state pension systems. That’s where State Pension Advisors can make a difference.

Our network of independent, fully licensed financial advisors specializes in understanding the complexities of state pensions across the U.S. When you work with us, you receive personalized advice tailored to your unique pension system, financial goals, and retirement plans.

From creating a comprehensive financial plan to aligning your assets wisely through asset allocation and asset management, our advisors cover all the primary types of wealth management with meticulous attention to your state’s specific rules. We also provide expert estate planning and tax accounting guidance, helping you make informed decisions that protect your wealth and legacy.

Reference - Delta wealth advisors

.png)

.png)

%20Rollover%20Rules.jpg)

%20Contribution%20Limits%20Explained.jpg)

.png)

.jpg)